Building Credit can be a scary ordeal but if you have the right information and guidance. You won’t be as hesitant your interest rate is one of the main defining factors on how your credit is allotted. There are many factors when dealing with this interest rate. It is directly tied to your credit score. Equifax and Credit Karma are just a few places you can check to see yours.

Suppose your score meets the qualifications, you are almost guaranteed to pay a substantially lower interest rate. The Bank or Loan company sees your outstanding credit history and is more willing to process that Loan for the house or property you have been looking at. Here are the Top Benefits I have experienced.

Better Chance for Credit Card and Loan Approval

Suppose your Borrowing from Lenders has multiple reasons for a better chance of approval. Now your score does play a vital role, and there are other factors. For example, Income and Debt are just two underlining reasons. There are a few questions one should ask themselves. How much debt am I carrying? Do I need a co-signer? How much positive Credit history do I have? So your chances are much greater if you can yes to these questions.

Get Approved for Higher Limits

This is something everyone’s eyebrow raises too. A higher Spending limit ” Music to your ears right.” Your borrowing is based on your Credit score and Income. So, in other words, the more you make, the more you can borrow sounds pretty simple. The only advice I would suggest is to look for the best interest rate the accommodates your needs. Being that your Interest rate depends on moving variables. Just make sure you are on top of what rate works best for you over time.

Easier Approval for Rental Houses and Apartments

Rental Property and Home purchasing also go hand in hand: your approval rate and chances of your Dream Home or Rental Property. More and More Landlords are using credit to screen potential clients. This means you could be denied just based on your credit history. This scenario had haunted me for a while before I actually did something about my credit portfolio. There is nothing worse than jumping through all the application process to determine that your credit score was the deciding factor as to why you were denied.

This can be very frustrating it’s almost as if you have a ball and chain tied to your leg forbidding you from any forward progression. Lets remove this burden from your life. As well as anyone in your family who you can help.

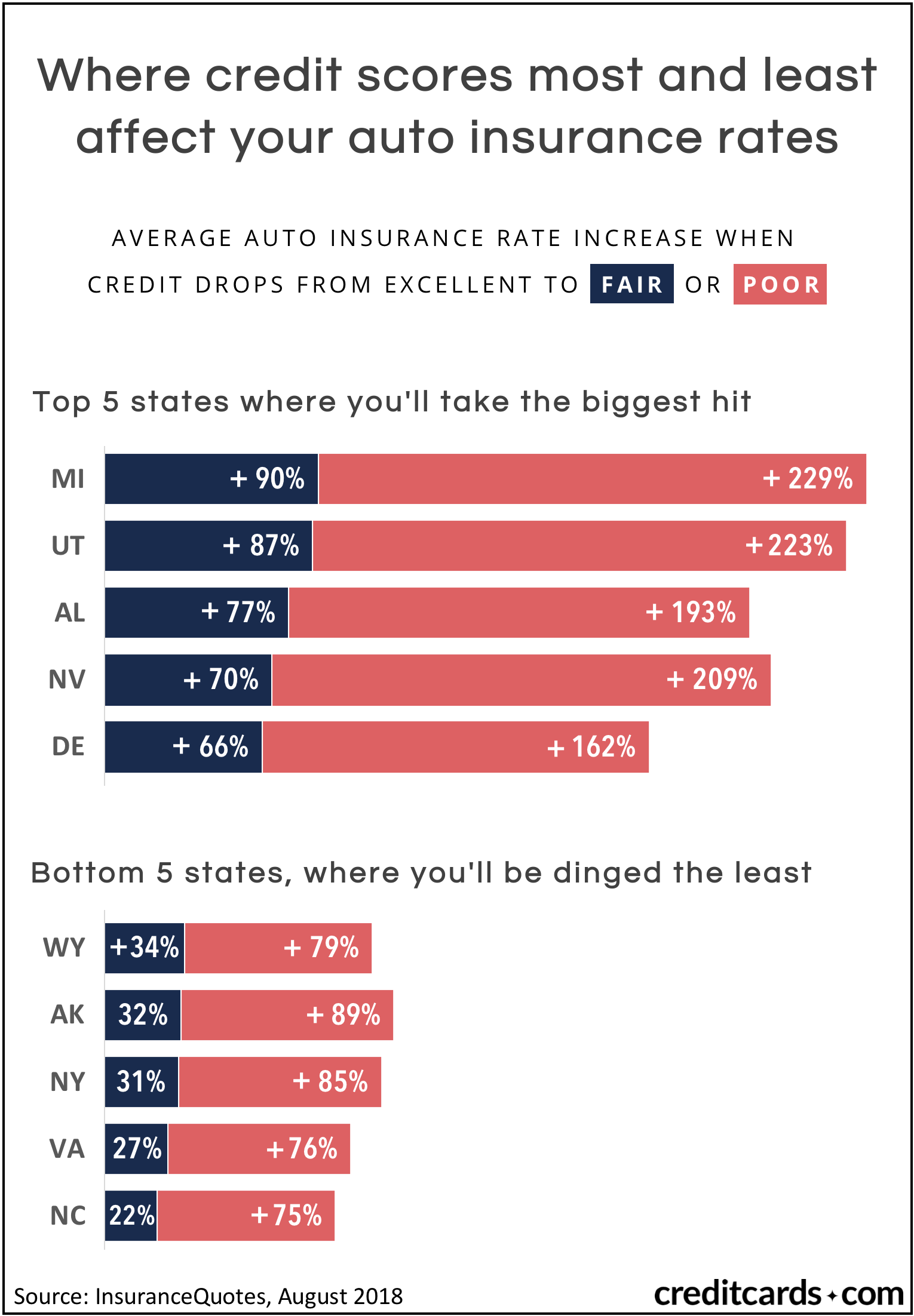

Insurance Rates

Take into account either not having enough credit or just negative credit scores. This also affects your insurance premiums to determine if your rates go up. High-Risk drivers already have significantly higher rates than most drivers. Just think if your interested in purchasing a new vehicle how high the interest rate would be. this same scenario with other Variation of Insurance companies. These asterisks towards your score having a spiraling effect.

Lenders use credit scores to determine the ability of a consumer to pay back a loan on time, such as mortgage refinances, student loan refinances, and personal loans.

Did you know that your score can cost you money? Thinking about getting the latest iPhone? That utility bill deposit just got a bit more expensive. Your score could have you spending more in the long run.

A score of 580-669 is considered fair, 670-739 is good and a score of 740 or higher is typically considered excellent. It doesn’t seem right, does it, but these systems are in place for business practices, of course.

Savings comes Naturally

I hope you can see the possibilities of getting your Credit Score in the upper 700 to 750 range. I know some people with unbelievable credit. There aren’t thoughts about not being approved for a Loan, Increased LOC, a million-dollar life insurance policy. The worst of them all hearing the negative balance alarm at the checkout at your nearest grocery store. Taking care of these things now prepares you for a brighter financial future.

Shaping you to being much more conscious of where your money goes and your spending habits. What are your habits? What is the first thing you do before you get paid? Is your money already spent by the time you get paid? Are you Paying yourself? All these topics and more to discuss in our coming Blog Post.

Setting yourself up for the seeds you will be sowing today is the only way. You and your family can reap the fruits of that financial freedom tomorrow.